Accounting is more than just number-crunching; it’s the backbone of any successful business. For Shopify store owners, a proper e-commerce accounting process ensures they can accurately track revenue, manage expenses, comply with tax obligations, and make informed financial decisions.

In this comprehensive guide, we will dig deep into the fundamentals of Shopify accounting, explore the essential terms and concepts, and review the best Shopify accounting software available.

Understanding Shopify Accounting Basics

To effectively manage your Shopify store's finances, it's crucial to start with a solid understanding of the Shopify accounting fundamentals. By mastering these basics, you'll be better equipped to keep your financial records accurate and your business on a path to sustained growth.

What is Shopify Accounting?

Shopify Accounting refers to the systematic process of recording, analyzing, and reporting the financial transactions and activities of a Shopify store. It involves tracking sales, managing expenses, reconciling bank accounts, and ensuring compliance with tax laws.

Source: Shopify

Although Shopify provides various tools to help store owners manage their finances, such as sales reports, order summaries, and payment processing, they are not a substitute for comprehensive accounting practices. Instead, they complement traditional accounting methods, making it easier to sync data with external accounting software.

Key Shopify Accounting Terms and Concepts in Ecommerce Accounting

Understanding key accounting terms and concepts is essential for effectively managing your Shopify store’s finances. Here are some of the most important terms you should be familiar with:

- Revenue vs. Income: Revenue is the total amount of money generated from sales before any expenses are deducted. Income is what remains after all expenses, including operating costs, taxes, and other deductions, have been subtracted from revenue.

- Expenses vs. Costs: Expenses refer to the money spent on the day-to-day operations of the business, such as rent, utilities, and salaries. Costs, on the other hand, are the amounts paid for producing or purchasing the goods that are sold, such as inventory and shipping costs.

- Purchase Order: A purchase order is a document issued by a buyer to a supplier, indicating the types, quantities, and agreed prices for products or services the buyer intends to purchase.

- Sales Order: A sales order is a document generated by the seller to confirm the sale of goods or services to a customer. It outlines the details of the order, including product descriptions, quantities, and prices.

- E-commerce Sales Tax: Sales tax is a government-imposed tax on the sale of goods and services. E-commerce businesses, including Shopify stores, must collect and remit sales tax based on the locations in which they operate.

Setting Up Effective Shopify Accounting for Your Store

Setting up effective accounting practices for your Shopify store is crucial to maintaining accurate financial records and ensuring long-term business success. By implementing the right tools and strategies, you can streamline your accounting processes and better understand your store's financial health.

Choosing the Right Plan for Your Shopify Accounting Needs

Shopify offers several pricing plans, each with different features and capabilities. Selecting the right plan is crucial for effective accounting and financial management.

Source: Shopify

- Basic: The Basic plan provides essential features, including 10 inventory locations, 24/7 chat support, and localized global selling for 3 markets.

- Shopify: The mid-tier plan includes everything in Basic, plus 5 additional staff accounts.

- Advanced: The Advanced plan includes advanced report building, 10x checkout capacity, and additional staff accounts. It's ideal for larger businesses that require in-depth financial analysis.

- Plus: The enterprise-level plan offers advanced customization, automation, 200 POS Pro locations with Shopify Payments, and localized global selling for 50 markets. It's suitable for large-scale businesses with complex accounting needs.

When choosing a plan, consider the size of your business, the volume of transactions, and the level of reporting detail you require. Investing in a higher-tier plan may provide better tools for managing your accounting processes.

Does Shopify Have Accounting Software? Top 5 Shopify Accounting Software You Should Know

While Shopify provides some basic financial tools, it doesn’t offer comprehensive e-commerce accounting software. To manage your Shopify store’s finances effectively, you’ll need to integrate third-party accounting applications. Here are 5 highly recommended software for you to choose from:

QuickBooks Online

QuickBooks Online is a powerful cloud-based Shopify accounting software designed to streamline financial management for your e-commerce store. It integrates seamlessly with popular sales channels like Shopify, reducing the need for manual data entry and ensuring that sales and payouts are accurately recorded across multiple platforms.

Source: Quickbooks Online

Key Features:

- Track income and expenses and maximize tax deductions for your Shopify business

- Connect Shopify's sales data to QuickBooks.

- Provide accurate accounting by reducing the need for manual data entry and shortcuts.

- Update stock levels between QuickBooks Online (Plus or higher) and Shopify.

Pricing: The prices range from $24.5 to $164.5 per month.

Pros:

- Shopify Inventory management is available with QuickBooks Online Plus and Advanced plans.

- Comprehensive double-entry accounting reports.

- Integration with third-party apps.

Cons:

- Monthly subscriptions are more expensive compared to other accounting software.

- Each plan restricts the number of users who can access the account.

- Advanced features require time and effort to master.

How to integrate the app with your Shopify store:

Step 1: Prepare Your Accounts

Before you begin the integration process, ensure that both your QuickBooks account and your Shopify store account are properly set up. Here’s what you need to do:

- Create a QuickBooks Online Account: If you haven’t already, sign up for QuickBooks Online and choose the plan that best suits your business needs.

- Set Up Your Shopify Account & Store: Make sure your store is fully operational. Also, ensure that your Shopify account is connected to your bank account, as this will be necessary for reconciling transactions in QuickBooks.

- Review Your Financial Data: Take some time to review your existing financial data in Shopify by going to Analytics > Reports and selecting the “Finances" category. This includes sales reports and payment information.

Find out more about Shopify’s dashboards & reports: Shopify Reports and Analytics: Master The Data In Less Than 10 Minutes

Step 2: Install the “Shopify Connector by Intuit” app, then sign in to your Quickbooks account.

Step 3: Select “Connect to Shopify” in the Connections tab.

Step 4: After that, you need to enter your Shopify store domain. Once done, select “Connect to Shopify”.

Step 5: Sign in to your store account in Shopify.

Your Shopify account is now connected and authorized with your QuickBooks Connector file.

Xero

Xero is another leading Shopify accounting software that offers features such as invoicing, inventory management, bank reconciliation, and multi-currency accounting. Xero also provides real-time financial data, allowing you to stay on top of your cash flow and make informed business decisions.

Source: Xero

Key Features:

- Offer customizable invoices, payroll integration, and comprehensive financial reports.

- Match Shopify transactions with bank statements in Xero, simplifying the reconciliation process and ensuring accurate financial records.

- Synchronize with your business bank account and make it possible for you to monitor your transactions.

Pricing: Xero offers three pricing plans: Starter ($14.5 per month), Standard ($23 per month), and Premium ($31 per month).

Pros:

- All plans offer unlimited users.

- Hubdoc, for automatic receipt and bill capture, is included in every plan.

- Capable of managing fixed assets.

- Strong project tracking capabilities.

Cons:

- Lacks automatic reminders for unpaid invoices.

- No phone support is available.

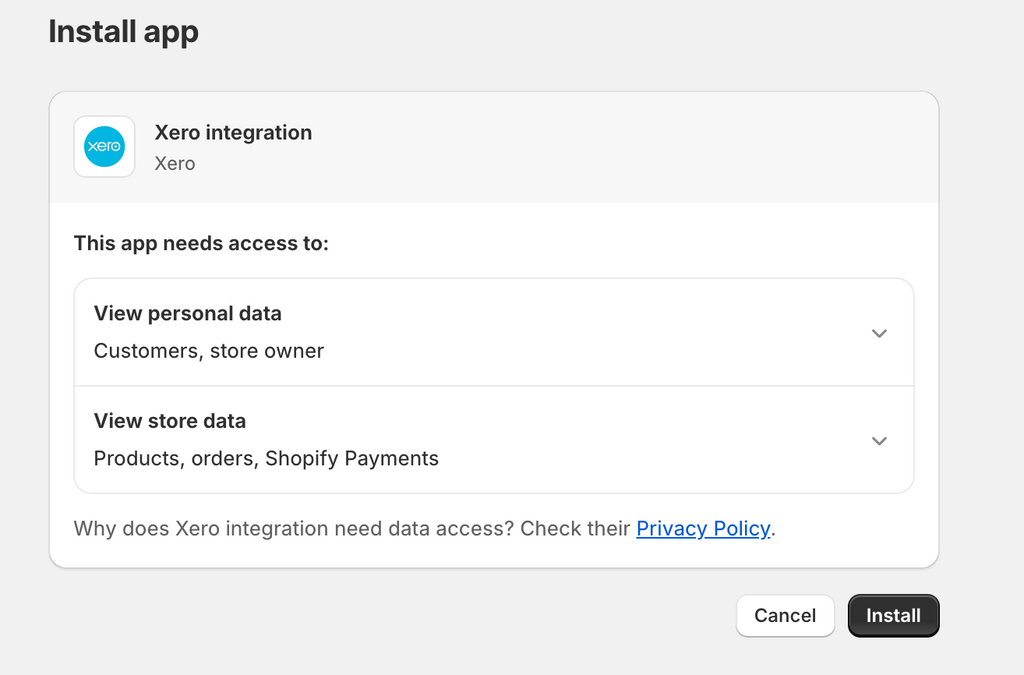

How to integrate Xero with your Shopify Store:

Step 1: Log in or sign up for Xero if you haven't had an account yet.

Step 2: Install the “Xero integration” app from the Shopify App Store.

Step 3: Click “Install" after reviewing permissions.

Step 4: Connect to your organization, and start the set-up process.

Step 5: Complete the set-up process consisting of these parts: Account and tax, Payment gateway, and Import data.

FreshBooks

FreshBooks is a Shopify accounting software designed for small business owners and freelancers. It offers features like time tracking, invoicing, expense tracking, and financial reporting. FreshBooks also integrates with various payment gateways, making it easier to manage payments from customers.

Source: Freshbooks

Key Features:

- Track and categorize expenses, including Shopify-related costs like transaction fees, shipping, and marketing.

- Accept payments directly through invoices with integrated payment processing options, allowing customers to pay online with credit cards or other payment methods.

- Connects directly with Shopify to sync sales data, invoices, and expenses.

Pricing: FreshBooks offers four pricing plans: Lite ($7.6 per month), Plus ($13.2 per month), Premium ($24 per month), and Select (custom pricing).

Pros:

- Excellent customer support with high ratings.

- All plans include time-tracking and mileage-tracking features.

- Offers a comprehensive suite of cloud accounting tools.

Cons:

- Restrictions on the number of users and clients allowed.

- The basic plans lack bank reconciliation and access to an accountant.

- Does not provide quarterly tax estimates.

How to integrate Freshbooks with your store:

Step 1: Log in or sign up for Freshbooks if you haven't had an account.

Step 2: Connect Freshbooks to your Shopify store with the FreshBooks Link by CarryTheOne app. This Shopify app is specifically designed to integrate with Freshbooks.

Zoho Books

Zoho Books is a cloud-based accounting software that offers features for Shopify bookkeeping like invoicing, inventory management, project management, multi-currency accounting, and financial reporting.

Key features:

- Integrate seamlessly with other Zoho apps as well as third-party platforms, including Shopify, for streamlined operations.

- Offer robust tax management features, including automated tax calculations, customizable tax rates, and detailed tax reports.

- Automate repetitive tasks by setting up custom workflows.

Pricing: Zoho Books offers four pricing plans to get you started: Free ($0), Standard ($10 per month), Professional ($20 per month), and Premium ($50 per month).

Zoho Books also offers more pricing plans for advanced features: Elite ($100 per month) & Ultimate ($200 per month).

Pros:

- Most accounting tasks can be handled via the mobile app.

- More cost-effective than many other accounting solutions.

- Supports multi-currency transactions in the top-tier plan.

Cons:

- Advanced features like project tracking and workflow automation require additional payment.

- Lacks the ability to track fixed assets such as real estate, land, or equipment.

- Each pricing tier restricts the number of users allowed.

How to integrate Zoho Books with your Shopify store:

For now, direct integration with Shopify is available within Zoho Inventory and is also accessible in higher plans of Zoho Books (Elite & Ultimate). For step-by-step instructions on how to connect Shopify with Zoho Inventory, kindly refer to this guide.

Or you can use Zapier which connects Zoho Books with several other apps including Shopify. This integration is available across all plans of Zoho Books.

Step 1: Log in or sign up for a new Zapier account.

Step 2: Search for Shopify and Zoho Books integration with Zapier, and click “Connect the apps".

Step 3: Select Shopify as the Trigger App & choose a Trigger Event.

Step 4: Connect your Shopify store with Zapier.

Step 5: Select Zoho Books as the Action app and choose an Action Event.

Step 6: Connect your Zoho Books Account.

Step 7: Review and activate the integration using Zapier.

Synder

Synder Sync is an accounting automation tool designed to help e-commerce businesses manage their finances more efficiently. It offers features like automatic reconciliation, multi-currency support, sales data synchronization, and real-time financial reporting.

Key Features:

- Provide a comprehensive breakdown of each transaction, including line items, taxes, fees, and discounts.

- Offer real-time synchronization of your sales and financial data, keeping your accounting records up to date with the latest transactions.

- Provide flexible data mapping options, allowing you to customize how transaction data is recorded in your accounting software

Pricing: Synder offers several pricing plans, starting at $61 per month for the Medium plan to $275 per month for the Large plan.

Pros:

- Automatic Transaction Syncing

- Multi-Currency Support

- Detailed Transaction Breakdown

- Real-Time Data Syncing

Cons:

- Synder can be more expensive than other accounting integration tools

- The app's wide range of features and customization options may require time to learn and configure correctly.

How to integrate Synder with Shopify:

Step 1: Sign up with Synder and set up your account information.

Step 2: Select Shopify as the platform you’d like to integrate.

Step 3: Select Synder as the accounting platform you want to connect.

Step 4: Connect your bank account.

Step 5: Click “Connect" to finish setting up Shopify & Synder integration.

Factors to consider when selecting the right accounting software for your store

When selecting the right accounting software for your Shopify store, consider the following factors:

- Business Size and Complexity: Assess the volume of transactions, the number of products, and the size of your team. Larger businesses may require more robust features than smaller ones.

- Pricing: Compare the costs of different software options and evaluate their value. Ensure the pricing aligns with your budget and the features offered.

- Customer Support: Evaluate the quality of customer support and the availability of resources, such as tutorials, guides, and community forums.

- Shopify Integration: Ensure that the software integrates seamlessly with Shopify to allow for efficient data transfer and synchronization. Poor integration can lead to errors and data discrepancies.

Setting Up Your Chart of Accounts for Shopify Bookkeeping

A chart of accounts is a systematic listing of all the accounts used in your accounting system. It categorizes your transactions and helps you organize financial data.

Start by categorizing your income and expenses into relevant accounts, such as:

- Income Accounts: Sales revenue, discounts, returns, and allowances.

- Expense Accounts: Cost of goods sold (COGS), advertising expenses, shipping costs, and administrative expenses.

- Asset Accounts: Inventory, accounts receivable, and bank accounts.

- Liability Accounts: Accounts payable, loans, and tax obligations.

Managing Finances and Transactions in Shopify Accounting

Managing your finances and transactions is crucial for running a successful online store. Let's find out how to implement the task effectively.

Tracking Sales and Revenue

Tracking sales and revenue is essential for understanding your store's financial health. Shopify provides built-in reports that allow you to monitor your sales performance, identify trends, and make data-driven decisions.

To access the report in the Shopify Admin, go to Analytics > Reports and select the “Sales" category.

Handling Expenses and Costs

As a Shopify store owner, you'll incur various expenses, such as inventory purchases, shipping costs, and advertising fees. You can manage expenses and costs in Shopify's financial report by going to Analytics > Reports and selecting the “Finance" category.

Dealing with Taxes and Compliance for Shopify Accountants

Tax obligations can be complex for e-commerce businesses, particularly when selling in multiple jurisdictions, making sales tax compliance crucial. It’s essential to understand your tax responsibilities and ensure compliance with applicable laws.

You can set up the sales tax rates & VAT based on your location and the locations of your customers by following the steps below:

Step 1: From the Shopify admin, go to Settings > Taxes and Duties.

Step 2: In the Region settings section, configure tax rates & VAT for your location and customers' locations.

Step 3: Save your changes.

Common Challenges and Solutions in Shopify Accounting

Navigating Shopify Accounting can present various challenges for online store owners. Understanding these common issues and their solutions can help ensure smooth and efficient financial management.

Typical Accounting Issues

Shopify store owners may encounter various accounting challenges, such as:

- Misclassified Transactions: Incorrectly categorizing transactions can lead to inaccurate financial reports and tax filings.

- Overlooked Expenses: Failing to record all expenses can distort your financial statements and result in underreported profits.

- Data Discrepancies: Inaccurate or incomplete data can lead to errors in financial reporting and decision-making.

Strategies for Overcoming These Challenges

To avoid and correct accounting errors, consider the following strategies:

- Regular Reconciliation: Regularly reconcile your accounts to ensure that your financial records are accurate and up-to-date.

- Automate Where Possible: Use accounting software to automate data entry and reduce the risk of human error.

- Stay Organized: Keep your financial documents organized and accessible, so you can easily reference them when needed.

Conclusion

Shopify accounting is a critical component of running a successful online store. By understanding the basics, and choosing the right tools, you can maintain accurate financial records, comply with tax obligations, and make informed decisions that drive your business forward.

In this guide, we've covered the essentials of Shopify accounting, as well as reviewed some of the top accounting software options available for Shopify store owners.

As you move forward, implement best practices, stay organized, and don't hesitate to seek professional advice when needed. With the right approach, you'll be well-equipped to manage your Shopify store's finances and achieve long-term success.

![27 Best Shopify General Stores + Complete Strategy Guide [2025]](http://pagefly.io/cdn/shop/articles/Best_Shopify_General_Stores_2f9d09f2-7c38-4da9-a495-e9f4898ddd68.jpg?v=1757271936&width=1640)