It's no strange that one day you suddenly think about selling your Shopify store. Whether you're ready for a new venture, looking to cash in on your success, or simply seeking a change, this can be a game changer.

It's more than just transferring ownership – it's about maximizing the value of your hard work and ensuring a smooth transition. In this guide, we'll walk you through everything you need to know about selling your Shopify shop successfully, from timing the sale to calculating the best value. Let's turn your store into an attractive asset for potential buyers.

When is the right time to sell a Shopify store?

Deciding when to sell your Shopify store is as crucial as how you sell it. The right timing can bring you a significant advantage. You don't want your business to be undervalued or worse, there's nobody interested in it.

Signs to consider selling

Of course, a 3-day-old business will be much more challenging to sell than a 3-year-old store. The right timing is all about your current business performance, but sometimes, it also relies on your mental state.

It might be time to think about retiring your Shopify store if:

- Market Opportunity: Your niche is experiencing high demand, and larger brands are actively acquiring smaller competitors. This can be an instant way to recover all your investment.

- Peak Performance: Your store shows strong, consistent growth and healthy profit margins. This opportunity is very attractive to potential buyers.

- Life Changes: You're ready to retire, relocate, or pivot to a new venture that demands your full attention. You want to have someone with the same passion to manage your store day-to-day.

- Business Plateau: You've reached a point where substantial growth would require significant additional investment or expertise. And your current position can't meet that.

- Business Burnout: You've lost the passion that once drove you, and now running the store doesn't have much excitement.

Best Time to Sell

Yet, despite having a growing niche and great market opportunity, not all stores can be sold or have the same value. To make a successful transition and bag the most profitable exit, you need to prepare your online store. It should:

- Consistent monthly revenue with an upward growth trend.

- Established systems and processes that run smoothly.

- A strong brand presence in your niche with a group of returning or loyal customers.

- Minimal seasonal fluctuations in sales.

- Clear potential for future growth that new owners can leverage.

But the final key would still be when you are fully ready to step away and let others take care of it.

How much can I sell my Shopify Store?

You have spent so much time and effort to build such a good store, and this can easily lead to an overly optimistic view of how much to sell. Many cases of over-evaluated scare away potential buyers or lose the right time to sell.

Keep in mind that your business value isn't based on how much work you've put into it. You need a more convincing data, such as your store performance, your growth rate, and return on investment (ROI).

Here are some common ways to evaluate:

Income-based approach

As its name implies, this strategy considers your store's cash flow and uses risk assessment to analyze its ability to generate income.

There are 3 methods:

- Discounted cash flow: This is great to use when your online store has yet to attain big numbers but shows strong potential for growth. You estimate the cash flow, then add the inflation rate and risk assessment to determine the final value.

- Capitalization of cash flow: This is best for established Shopify stores with steady income and groups of loyal customers. Unlike the above, you won't focus on economic changes but only calculate the annual returns, and expected value based on future profitability.

- Leveraged buyout analysis: This provides a floor valuation of your Shopify store. This method is usually used by the buyer to estimate how much they get after buying your store.

Market-based approach.

This method compares your store to similar ones in the market and estimates a suitable value. Because of that, it's best for a store that is in a growing market.

You can also use your business age as one criteria. The older your business is, the more it has proven itself against the test of time. Secondly, it shows you have a recognizable brand and a large customer base to support the new owner.

Asset-based approach

In this evaluation method, you look into the value of tangible and intangible assets.

- Tangible assets are physical ones such as inventory, equipment, and the Shopify storefront.

- Intangible assets are intellectual property, license, brand name, social media presence, social proof, and customer base.

This is best if you want to close and sell everything, including the equipment. Some merchants only want to sell online Shopify stores, yet keep the manufacturing equipment for their new venture.

To have a more accurate estimation, you can use valuation tools like Empire Flipper as a reference.

Monthly net profit method

This is the most common approach for eCommerce businesses. Take your average monthly profit from the last 12 months and multiply it by 24-45, depending on your store's performance, like this.

A lot of other business brokers use average annual profit instead. The problem with this method is that it doesn’t accurately reflect the true state of your business. Within those twelve months, your business could have had dips and spikes in performance which aren’t accounted for in a TTM.

It benefits you as a seller to use a monthly average because the more potential business buyers understand the history of your business, the more likely you are to receive offers.

Although this is the most simple evaluation strategy when selling your Shopify store, what’s not so simple is your business sale multiple.

Many factors are considered to calculate your multiple, but the main ones are as follows.

Factors That Impact Your Store's Value

- Growth History and Potential: Do you have a consistent upward revenue trend? What is your new product development pipeline and market expansion strategy to nurture growth?

- Operational Efficiency: Do you use automated tools to fasten production? Do you have a reliable supplier or drop shipping relationships? How efficient is your inventory management?

- Customer Base Quality: This includes retention rates, average order value, lifetime value, acquisition costs, and review ratings.

- Market Position: Do you have good brand recognition? What are your USPs and competitive advantages? How much is your market share?

- Business Documentation: Do you have clear financial and legal records to support an authorized transition? Are your numbers transparent enough?

- Business Age: This proves your standing in the market.

Pro tip: Consider using a professional business broker or valuation expert to get an accurate assessment. They can provide detailed insights into your store's worth and help identify areas for improvement before listing.

Before starting the selling process, make sure your store looks its best. Update your store design with PageFly's easy-to-use editor, organize your documentation, and ensure all systems are running smoothly. A well-maintained store not only commands a better price but also attracts serious buyers.

Not just selling your Shopify store, learn other ways to earn money on Shopify as well.

Who can I sell my Shopify shop to?

Once you have a valuation figure in mind, your next step is to find interested buyers.

As Shopify continues to grow, launching an entirely new store can be more challenging to compete. This is where people start to look for already-built stores. Imagine they can skip the setup process and immediately jump into selling, while you get a big treat for all the effort in the past. It's a win-win trade.

The common type of Shopify store buyers:

- Some look for businesses with room for improvement so they can fix up the business and quickly make a return on their investment.

- Others have a portfolio of various types of online businesses that work synergistically to make the buyer cash flow.

- Some have huge funds and are looking for a business that runs itself as a passive investment.

Where to sell a Shopify store?

Different platforms and methods may appeal to different types of buyers and provide different valuation models. Assessing where to sell allows you to select the platform or service that best complements your company's strengths, potentially increasing the market value you can command.

Private Sale

This "out of the wild" approach gives you 100% freedom to select who and how to sell your business to. You can reach out to potential buyers through social media or online communities.

Pros:

- There's no extra fee for agents, brokers, or marketplace.

- This can happen in a long time until you find a suitable buyer.

Cons:

- There's no way to qualify if a buyer has real demand or a scam.

- You have to find a buyer on your own.

- A common occurrence in private sales is an inexperienced seller setting a sale price that’s way too high. An experienced buyer sees this as a sign of inexperience and out-negotiates the seller to make them sell for less than the business’s true value.

To go this route, you’d need to have buyer contacts you can trust and lawyers who can ensure the transaction is legal, and that both parties fulfill their duties in the deal.

If you don’t have those in place, and especially if this is your first business sale, then selling privately will be risky.

Marketplaces

Selling Shopify stores on dedicated marketplaces is a step up from private sales. Although they function in the same way, having a platform to back the process will make it safer, faster, and more effective.

Having said that, you will be solely responsible for the safety of the sale. You will need to make sure it’s legal and carried out correctly, just like you would with a private sale.

Pros:

- By listing on the marketplace, you immediately sell your Shopify store to potential buyers, without having to look for one.

- An effective way to promote your Shopify store to buyers.

- They take care of many legal-related tasks and secure the transaction.

- Some marketplaces may even offer some professional advice.

Cons:

- You need to pay.

- You directly compete with many other stores that want to be sold.

Here are our reviews of some top marketplace of Shopify stores for sale:

| Marketplace | Description | Best for | Total sold | Fee | Evaluation method |

| Empire Flippers | The leading M&A brokerage and the world’s largest online business marketplace. | Profitable stores with $100,000 to $10 million in value. | 2,400+ online businesses, $520 million in total. | Stacked commission structure with a 2.5% to 15% rate. | Average monthly net profit for the last 6 to 12 months and multiply it by 20 to over 60 times, depending on a finance and operation state. |

| Open Store | A dedicated marketplace for listing Shopify Stores to sell, helping you maximize your exit fast without sweat. | Shopify store with $1 million annual revenue | Serving 2 million buyers and sellers | Direct buy-out, no commission | A review of sale channel, total net sales, business age, margins, and customer metrics. They have a streamlined listing process that only takes 3-5 business days. |

| Flippa | A marketplace for buying and selling online businesses, websites, blogs, and many more. | Small to mid-size stores that look for a quick exit | 450,000+ deals closed. | Flat listings fee with success fee ranging from 10% to 3% | To sell Shopify Store on Flippa, you'd need to provide a minimum 12-month financial history and key operational details. The listing process takes around 45 minutes. |

| Quiet Light | One of the most trusted partners for individuals looking to sell theireCommerce, SaaS, and Content service businesses. | Stores with $500K to $20 million in value. | 750 online businesses, $500 million in total. | No listing fee. Yet the final success fee varies case by case | There is a free valuation and marketplace-readiness assessment in Quiet Light. |

| eCommerce Brokers | A team of experienced M&A brokers that focus on eCommerce stores. | Stable Shopify store with $200K and more in revenue. | Over $50 million in total sales. | Undisclosed | Thorough vetting process with strict guidelines and requirements. |

These are all the most trusted marketplaces to sell your Shopify store. You can opt for one platform or list many at once to increase your chance.

03. Business Broker

This is the safest and probably the most efficient way to sell your business.

A broker is an individual or firm that has buyer contacts. If they think your business is a match for the type of business their buyer contacts are looking for, then they will put you in contact with those buyers.

Pros:

- They have a close connection with your potential buyer and can effectively promote your Shopify store.

- In-depth experience in selling Shopify stores. If you post on a marketplace, you have to do everything on your own.

- Involve in every stage to guide you.

Cons:Higher charge of service than a marketplace.

How to successfully sell a Shopify store

For a seamless and successful transition, a strong store is needed, of course, but not everything. To have a better impression, you need to take a few extra steps.

Tip 1: Preparing your store

You probably have some things at the back of your mind that you need to do with your business. Six to three months before the sale is the time to do them.

Operational changes are the biggest one here. If you have any inefficiencies in your processes or you’re underperforming in certain areas such as inventory management, now is the time to fix those problems.

What to do?

- Create standard operating procedures (SOPs) for all of your important operations and make sure to refine them.

- Investing in automation tools to speed up your process. Less time spent on manual work is an attractive offer. Here're the top Shopify Apps to use.

- When you pass your business to the new owner, your supply chain partner isn’t obligated to keep the same rates they had with you. Getting a written supply rate agreement that is transferable to a new owner will be worth its weight in gold to a buyer.

- If you want to go the extra mile to make your business that much more appealing to potential buyers, then you can create a future marketing plan to help the buyer see how the business can grow.

- Refine your product, customer base, order tracking, and return policy.

- Update your terms of service. Doing this helps avoid any tricky situations for a new owner down the line.

Tip 2: Update your store look

Similar to your customer, a good-looking, professional, and optimized storefront is also attractive to potential investors. This means they don't have to spend another resource to fix your storefront. And you can use this advantage to raise the price.

Here's what to note:

- Make sure all your pages are mobile-optimized.

- Make sure all the navigation, CTA, pop-ups, slideshows, and animations are in the right place.

- Make sure your design is not too old-fashioned. It must be attractive to your ideal customers.

- Your site must be easy to navigate.

- Product listing should have high-quality images and clear descriptions.

- Adding social proof and trust badges to your site is also a way to say that you have good brand presence.

Using Page Builders like PageFly can help you easily design a section exactly how you want.

Most Shopify themes don't allow you to customize, meanwhile, you can effectively add a personal touch with PageFly, then add that section or element directly onto your current theme in one click.

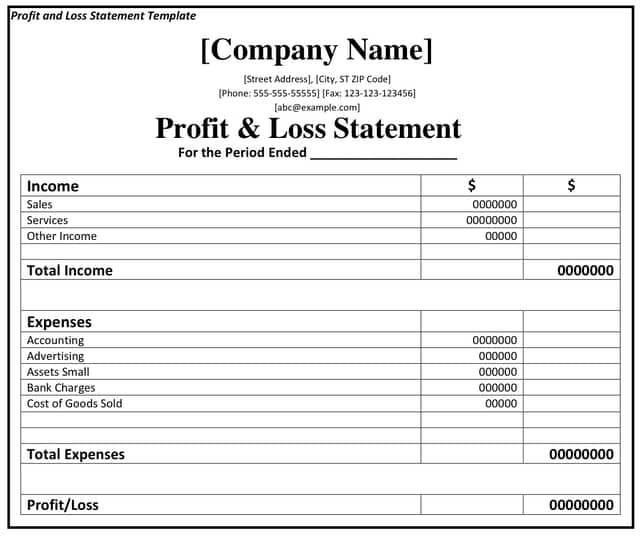

Tip 3: Prepare the data and documents

At this point, you want to review your numbers.

When buyers are reviewing your business as an asset, one of the first things they’re going to be looking for is its financial history.

The financial history of your business tells its story. For example, if you had a dip in profits one month, there will likely be a reason for that and a buyer will want to know that reason.

If it’s due to a stock out, it tells the buyer that your business has had issues with inventory management, but this isn’t necessarily a bad thing. Some buyers will see that as an opportunity to come in and improve inventory management for a quick and easy return on their investment.

To present your financials, you should create a profit and loss statement (P&L), or have your accountant do this for you.

Retains all your records and bills on Shopify before the sale to use as proof.

The other figures you need to prepare are your store performance analytics.

For a Shopify store, you need to export traffic and engagement data from tools like Google Analytics and export sale data from Shopify Analytics. The best time range is the last 6 to 12 months.

Take a look over the financial and traffic history of your store and prepare some explanations for why there were dips or spikes ready for negotiation

In the final 30 days before the sale, you want to update your P&L and make sure your employee contracts are transferable in case the buyer would like the employees to continue with the business after the sale.

Once you’ve decided on the date you want to list for sale, you just need to decide how you’re going to sell and prepare the necessary processes to execute the sale.

Tip 4: Negotiation Tips

Negotiation happens when there's a conflict in pricing. Most cases are the buyers think the suggested value is high for its real worth. Others just simply do it to see if you can lower the price.

How to talk to them without scaring them away?

- Be upfront and clear.

- Prepare data and answer to back up why you think this price is right and that you can't go any lower.

- Determine a floor price and stick to it. For example, if you list your Shopify store for $175,000, the lowest you can go is $150,000 - so when a buyer asks for $140,000, kindly deny them.

- Consider other deal structures. It's great if your buyer can pay upfront and match the amount you want. But sometimes you can explore other agreements such as earn-out agreements.

Post-sale considerations

Selling your Shopify store isn't the end of the journey - it's crucial to handle the transition period professionally to ensure a smooth handover and protect both parties' interests.

Here's the checklist of what to do:

- Update billing information. You can follow this official guide here.

- Update payout information and remove your payment info before transferring access to protect personal data. Follow this guide onedit your back account in Shopify Payment.

- Update contact details in your custom domains if you have any.

- Update your store notification information so you stop receiving emails about orders.

- Give Shopify POS permissions if you have one.

- Transfer store ownership.

In your Shopify Admin > Settings > User and Permissions > Store owner > Transfer ownership.

Fill in all the necessary data. Once you're done and confirmed, you will lose access to your store.

Then your buyer should accept ownership of your store from their Email notification.

To complete the transfer of your online business and not just the online store, you also need to check your tax and legal information for the store. Make sure you've changed it to the new owner.

Besides that, remember to transfer knowledge to your buyer, including:

- Document all operational procedures.

- Create training materials for key processes.

- Share customer service protocols.

- Provide supplier communication guidelines.

Also read: How to Change Shopify Store Name In Under 2 Minutes

Case study of Successful Shopify Store Sale.

Let's learn the tactic these people use to sell their Shopify store for 6 to 8 figures.

Back in 2018, a jewelry and personal care store received over $12 million after selling its Shopify business on Empire Flippers. Here's how they do it:

- They have a stable revenue stream by selling both single-item and subscription boxes.

- Thanks to the subscription boxes, they can accurately predict their inventory, with a main supplier in China and 6 other sub-suppliers across the world.

All of these prove a high ROI potential to buyers and less certainty to endure. Here are some top Shopify apps for subscription models like this store. You can learn more about the case here.

Did you know that many people also flip Shopify stores as their venture? They usually acquire small online stores, give them a makeover, improve their performance, and then sell those Shopify stores to others.

V. Sell Shopify Store to Start Your Next Chapter

Shopify businesses, whether they’re based on DropShipping or a traditional eCommerce model, are attractive assets.

These types of businesses, from five figures right up to eight figures and beyond, are being actively sold.

There are Shopify store owners everywhere cashing out from their businesses for a capital windfall that is likely bigger than they’ve ever received in their life. Having that cash load and free time allows them to reinvest in new projects, buy a home to start a family, or acquire a new business and continue that perpetual wealth-building cycle.

![27 Best Shopify General Stores + Complete Strategy Guide [2025]](http://pagefly.io/cdn/shop/articles/Best_Shopify_General_Stores_2f9d09f2-7c38-4da9-a495-e9f4898ddd68.jpg?v=1757271936&width=1640)